Osborne, a single mother who works as a project administrator in Tennessee, said her refund should amount to more than $4,400, which will cover about four months of rent. "I check 'Where's My Refund?,' and it says it's still being processed - I called the IRS after 21 days, and you can't get through to anyone." She filed her 2020 tax return on February 27. "My tax person said he was shocked if I wouldn't see my refund in 10 days, and it's been over two months," said Hillary Osborne, 41. With more than 40 million taxpayers yet to file, it's likely a portion of those returns will end up flagged for review - leaving those taxpayers with an unknown wait for their refunds, rather than the usual three-week turnaround. Rising CEO pay amplifies calls to tax the ric.

All that can add time to processing a tax return, which, in turn, means delays for taxpayers in getting their refunds.Ībout 1 in 3 people who have claimed the Recovery Rebate Credit have had their returns flagged for review by an employee, according to a May 6 report from the Treasury Inspector General for Tax Administration. In such instances, the IRS flags the return for review - that requires an employee to check the return against the agency's record of stimulus payments. Some people are incorrectly filling out that line, typically by claiming the incorrect amount on the form. One of those relates to the "Recovery Rebate Credit," the line on Form 1040 that allows people to adjust their stimulus payments if they didn't receive all the funds to which they were entitled. Some of those newly filed tax returns are getting flagged by the IRS because of issues related to recent tax changes and federal stimulus checks, Collins said.

But much of the backlog also consists of 2020 tax returns, which are still flowing into the IRS. Some of those returns are paper tax filings from 2019, which the IRS got behind in processing due to the coronavirus pandemic last year.

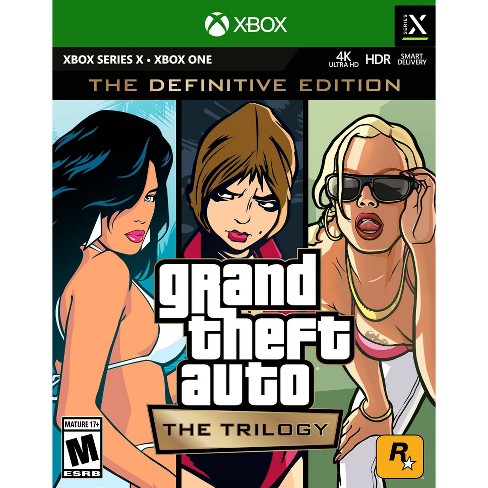

GRAND THEFT AUTO III XBOX MANUAL

Collins had flagged the issue in an April 22 blog post, when the number of tax returns held up for manual processing had reached about 29 million.

0 kommentar(er)

0 kommentar(er)